As the surge of individuals gearing up to control their financial futures has noticeably increased, the craving for quality investment education has also exploded. With the multitude of online courses that are rumored to be the key to stock market success, it is becoming even tougher for prospective investors to tell the difference between credible educational courses and those that are merely hyped.

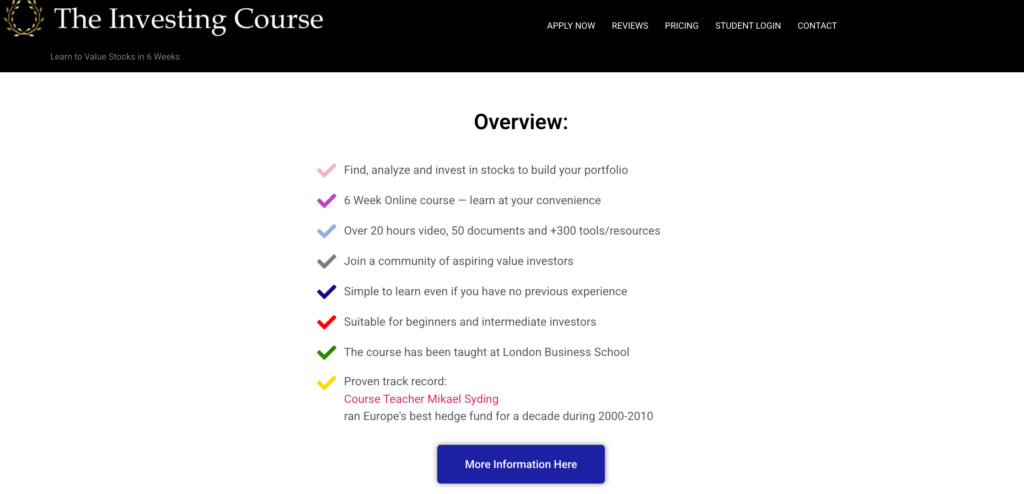

The Investing Course, taught by Mikael Syding and Ludvig Sunstrom, positions itself as a comprehensive program designed to teach fundamental analysis and stock selection methodologies used by professional equity analysts. The course delivers 20+ hours of video content, 50+ documents, 5+ financial models, and access to 300+ curated resources, all structured across a 6-week curriculum covering everything from valuation techniques to portfolio management.

What distinguishes this course is its association with London Business School, where Mikael Syding has served as a guest lecturer, and Syding’s 30-year track record in financial markets, including managing a hedge fund that won European Hedge Fund of the Decade honors. But credentials alone don’t guarantee an effective learning experience or justify the investment.

This review provides an objective, detailed assessment of The Investing Course, examining its content quality, instructor expertise, practical value, pricing structure, and both strengths and limitations. Whether you’re a beginner seeking structured investment education or a working professional looking to enhance your financial skills, this analysis will help you determine if this course aligns with your goals and justifies the commitment.

Course Overview

The Investing Course is structured as a self-paced, 6-week program designed to transform beginners and intermediate investors into confident stock analysts. The curriculum delivers 20+ hours of video instruction, 50+ supporting documents, 5+ financial models, and a curated database of 300+ tools and resources that students can access for life.

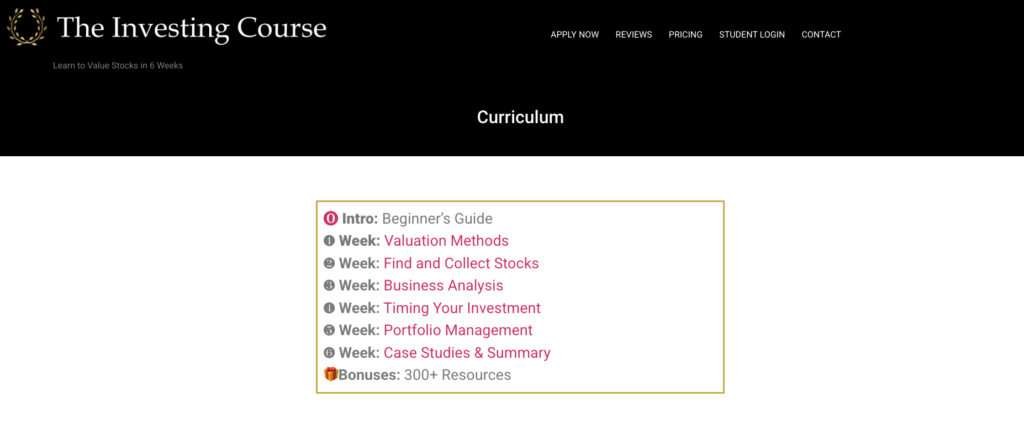

The organization of the program is in seven different modules, which sequentially develop from the most basic topics to the most advanced applications. Starting out the course provides a beginner’s guide introduction. It is followed by Week 1’s deep dive into valuation methods, where students learn seven different stock valuation techniques.

Week 2 focuses on finding and collecting stocks through screening methodologies, while Week 3 covers comprehensive business analysis. Week 4 addresses timing your investment using technical indicators, and Week 5 teaches portfolio management with emphasis on ranking investments by risk/return ratio. The curriculum concludes with Week 6’s case studies and summary, plus bonus access to the 300+ resources database.

Two package options are available to students: Basic and Plus. Both packages offer full access to all video content, documents, financial models, a private Facebook group for peer interaction, and an exam that leads to a diploma credential. The course is designed for practical learning, focusing on the real-world tools used by professional equity analysts in the eight key areas: valuation, fundamental analysis, stock screening, macroeconomic evaluation, technical analysis, portfolio construction, financial modeling, and position sizing.

The self-paced format enables working professionals to go through the course material on weekends or evenings without disrupting their careers, whereas lifetime access provides them with the option to revisit content indefinitely and to benefit from any new updates that are made in the future.

Instructor Expertise and Credentials

The credibility of any investment course rests heavily on the expertise of its instructors, and The Investing Course is led by two distinct professionals with complementary backgrounds.

Mikael Syding serves as the primary instructor, bringing 30 years of experience in financial markets to the curriculum. His career trajectory demonstrates sustained success across multiple market cycles. Syding began as a broker assistant at a small Swedish firm in 1995, quickly advancing to become Sweden’s #1-ranked analyst for investment companies by 1997-1998. In 1998, he was selected for the prestigious Swedbank Executive Education Program.

From 2000 to 2014, Syding worked as a hedge fund manager and partner at Futuris, later part of Brummer & Partners. During this tenure, his fund achieved extraordinary performance, earning the European Hedge Fund of the Decade award for 2000-2010. Over a decade-long period, Syding’s fund outperformed the index by 600%, and remarkably recorded zero negative years during his 15-year management tenure. This track record places him among Europe’s most successful hedge fund managers of that era.

Following his retirement from active fund management, Syding transitioned to roles as a venture capitalist, private investor, and podcaster, while maintaining active involvement in investment education. He holds a 4-year Master’s degree from Stockholm School of Economics and has served as a guest lecturer at London Business School, where The Investing Course has been taught. His presentations have reached audiences at major investment banks, further establishing his credibility within professional finance circles.

Ludvig Sunstrom serves as co-instructor, contributing expertise in learning systems and content creation. An entrepreneur and author, Sunstrom co-hosts one of Sweden’s prominent business podcasts and maintains a substantial online following. His specialization lies in developing practical methodologies for skill acquisition and personal development, complementing Syding’s technical financial expertise with structured learning frameworks.

This combination of proven investment performance and educational design creates a teaching team with both market credibility and instructional capability.

Content Quality and Learning Outcomes

The Investing Course delivers a comprehensive curriculum structured to progress from fundamental concepts to advanced practical application. The 20+ hours of video content span seven weeks of material, beginning with an introductory beginner’s guide and advancing through increasingly sophisticated topics.

The curriculum architecture follows a logical sequence mirroring the actual investment process professional analysts use. Students start with valuation methods in Week 1, learning seven distinct stock valuation techniques that form the foundation of fundamental analysis. Week 2 transitions to stock screening, teaching students how to find and collect investment candidates using both free and paid tools. Week 3 deepens analytical skills with comprehensive business analysis methodologies for evaluating company fundamentals.

Week 4 addresses the critical challenge of timing, introducing technical indicators that help investors determine optimal entry and exit points. Week 5 covers portfolio management, specifically teaching students to rank investment ideas by risk/return ratio, a needed skill for capital allocation. The program culminates in Week 6 with real-world case studies and a comprehensive summary, allowing students to see how all learned concepts integrate in practice.

Beyond the structured weekly modules, students receive access to 50+ supporting documents and 5+ financial models that enable hands-on practice. These models allow students to apply valuation techniques and forecasting methodologies to actual companies, bridging the gap between theoretical knowledge and practical execution.

The course’s most distinctive feature is its database of 300+ curated resources, tools, platforms, websites, and services used by professional equity analysts. This compilation represents significant time savings, as assembling such a resource library independently would require extensive research and testing.

Student testimonials provide evidence of content effectiveness. René Hermanns, a German engineer working full-time, completed the course on weekends and evenings, noting it transformed his ability to “navigate the world of finance and investing.” Gregory Getia, a senior director at Georgia Capital who took the course during his Master’s in finance at London Business School, stated the content benefits “people with relatively advanced knowledge of investing as well as those just starting their journey.” Andrianto Guntoro, now an Equity Research Associate at AB Bernstein, emphasized the course’s relevance “both for students who want to sharpen their investing skills and those who aspire to work in an equity research role”.

Pricing and Value for Money

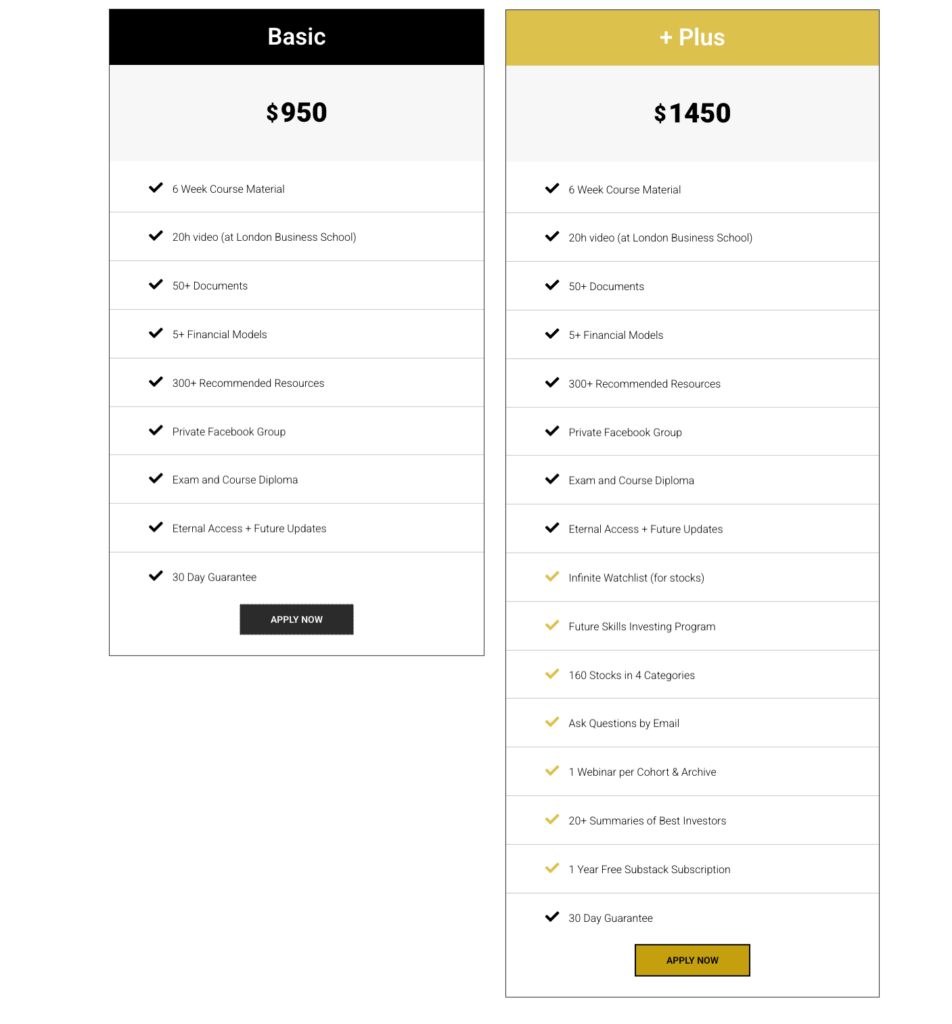

The Investing Course offers two distinct package tiers with transparent pricing designed to accommodate different student needs and commitment levels. Both packages provide lifetime access to course materials and future updates, ensuring long-term value beyond the initial purchase.

Package Breakdown and Pricing

The Basic Package delivers comprehensive access to all core educational content:

- Complete a 6-week curriculum covering the introduction through case studies

- 20+ hours of video lectures recorded at London Business School, plus practical screenshare demonstrations

- 50+ supporting documents, including guides, worksheets, and reference materials

- 5+ financial models for hands-on valuation practice

- 300+ curated resource database of websites, tools, and platforms used by professional analysts

- Private Facebook group membership for peer interaction and community support

- Exam access anda course diploma that can be added to your resume

- Eternal access with future updates, ensuring you benefit from curriculum improvements indefinitely

- 30-day money-back guarantee with no questions asked

The Plus Package includes everything in Basic, plus seven premium features designed for serious investors:

- All Basic Package content (20+ hours video, 50+ documents, 5+ models, 300+ resources, group, diploma, eternal access)

- Infinite Watchlist functionality for tracking unlimited stocks

- Future Skills Investing Program for continued learning beyond the core curriculum

- 160 pre-analyzed stocks organized into 4 distinct categories

- Direct email support allows students to ask questions directly to instructors

- One webinar per cohort, plus archive access for live interaction with Mikael Syding and Ludvig Sunstrom

- 20+ summaries of renowned value investors profiling their strategies and approaches

- 1-year free Substack subscription to instructor-curated investment content

- 30-day money-back guarantee

The Plus package represents a $500 premium over Basic, justified primarily for students seeking ongoing instructor interaction and advanced portfolio tools.

Value Assessment

When evaluated against alternative investment education options, The Investing Course demonstrates competitive positioning. Harvard Business School’s online investing courses charge $1,750-$1,850 for certificate programs like Alternative Investments and Sustainable Investing, while their in-person executive investment workshops cost $12,000 or more. Other university-affiliated investment programs, such as Yale’s Executive Education courses and MIT’s professional certificates, typically range from $3,000 to $8,500. Many standalone online investing platforms charge $199-$400 for introductory courses with significantly less content depth and no lifetime access.

The lifetime access provision significantly enhances the value proposition. Unlike subscription-based learning platforms or time-limited course access, students can revisit material indefinitely as market conditions evolve or when reviewing specific methodologies. The 300+ resource database alone represents substantial value; independently compiling such a comprehensive, vetted toolkit would require months of research.

For working professionals, the self-paced format eliminates opportunity costs associated with rigid class schedules. The diploma credential provides tangible resume value for those pursuing finance careers or transitioning into investment roles. The 30-day guarantee eliminates enrollment risk, allowing students to evaluate course quality and teaching style before committing financially.

Pros, Strengths, Cons, and Limitations

- Strengths and Advantages

The Investing Course offers several compelling advantages that justify enrollment for the right candidate. First, instructor credibility stands paramount. Mikael Syding’s 30-year track record in financial markets, including European Hedge Fund of the Decade recognition and 600% outperformance over a decade, provides genuine authority. His transition to teaching at London Business School and continued involvement in investments demonstrate sustained expertise beyond theoretical knowledge.

The curriculum comprehensively covers the entire investment process. Rather than focusing narrowly on single topics, the course teaches seven valuation methods, fundamental analysis, stock screening, macroeconomic evaluation, technical analysis, portfolio construction, financial modeling, and position sizing. This breadth ensures students develop well-rounded analytical capabilities.

The 300+ resource database represents substantial practical value, saving students years of independent research to identify effective tools and platforms. The self-paced format accommodates working professionals, as evidenced by René Hermanns, a full-time German engineer who completed the course on weekends and evenings. Lifetime access ensures students can revisit material indefinitely and benefit from future updates without additional costs.

Community support through the private Facebook group provides peer learning opportunities, while the Plus package offers direct instructor access and monthly webinars. The 30-day money-back guarantee reduces enrollment risk, and the diploma credential adds resume value for finance career advancement.

- Limitations and Realistic Considerations

However, prospective students should understand important limitations. The course cannot guarantee market outperformance; teaching investment methodologies differs fundamentally from guaranteeing profitable returns. Individual results depend entirely on student discipline, execution quality, market conditions, and timing decisions beyond any course’s control.

The self-paced format requires strong personal motivation. Without accountability mechanisms or rigid deadlines, procrastination can derail progress, particularly for students lacking disciplinary habits.

Time commitment is substantial. Beyond 20+ hours of video content, students must dedicate additional time to assignments, financial modeling practice, and stock analysis. Working professionals must realistically expect to invest 10-15 hours weekly for six weeks minimum.

The valuation-focused curriculum emphasizes fundamental analysis, potentially overlooking alternative investment classes like bonds, commodities, or cryptocurrencies. Technical analysis receives less depth than fundamental approaches.

Finally, theoretical knowledge alone doesn’t replace real-world experience. Emotional discipline, portfolio psychology, and live market execution present challenges no course fully addresses.

Ideal Student Profile

The Investing Course is best suited to learners who want a structured, end‑to‑end roadmap for stock investing built around fundamental analysis and the tools used by equity analysts. It fits people who value depth (20+ hours of video plus 50+ documents and 5+ models) and are willing to practice with real companies over a six‑week curriculum. The included 300+ resources can appeal to learners who prefer curated tools instead of searching the internet from scratch for months on end.

This course is a strong match if you are:

- A beginner who wants to progress from a “Beginner’s Guide” to valuation, business analysis, timing, and portfolio management in a single program.

- An intermediate DIY investor who already buys stocks but wants more rigorous valuation methods (seven approaches) and a clearer process for screening and idea generation.

- A busy professional who needs flexible learning and would benefit from the private group and (if you choose it) added support features in higher tiers.

- Someone building career-relevant skills in analysis and modeling, and who values an exam and diploma outcome.

It may be less suitable if you want a course centered mainly on non‑equity assets or prefer purely passive investing with minimal analysis work.

Conclusion

The Investing Course is positioned as a structured, fundamentals-first program for learning stock investing using methods associated with equity analysts, anchored by a clearly staged curriculum (Intro through Week 6 case studies) and a strong emphasis on valuation, analysis, timing, and portfolio management. On tangible deliverables alone, it offers substantial material: 20+ hours of video, 50+ documents, 5+ models, a private group, a diploma pathway, and 300+ resources, which makes it more than a lightweight “crash course” for casual learners.

That said, the course is most compelling for readers who will actually use the frameworks: practicing valuation (seven methods), building watchlists, and applying the process repeatedly beyond the lessons. For people seeking a step-by-step system to analyze stocks and who can commit consistent time to work through the modules, the course has a clear value proposition. Those who prefer purely passive investing or want faster, minimal-effort guidance may find the workload and depth mismatched to their goals.